corporate tax increase build back better

The Prior House Bill contained a proposal to increase corporate tax rates which together with the proposed changes to the QSBS rules would have further limited desirability of investing in. Raising the corporate tax rate to 28 would give the US.

Would Biden S Tax Plan Help Or Hurt A Weak Economy The New York Times

Biden had wanted to increase the corporate tax rate from 21 to 28 the top income tax bracket from 37 to 396 and tax capital gains for the richest Americans.

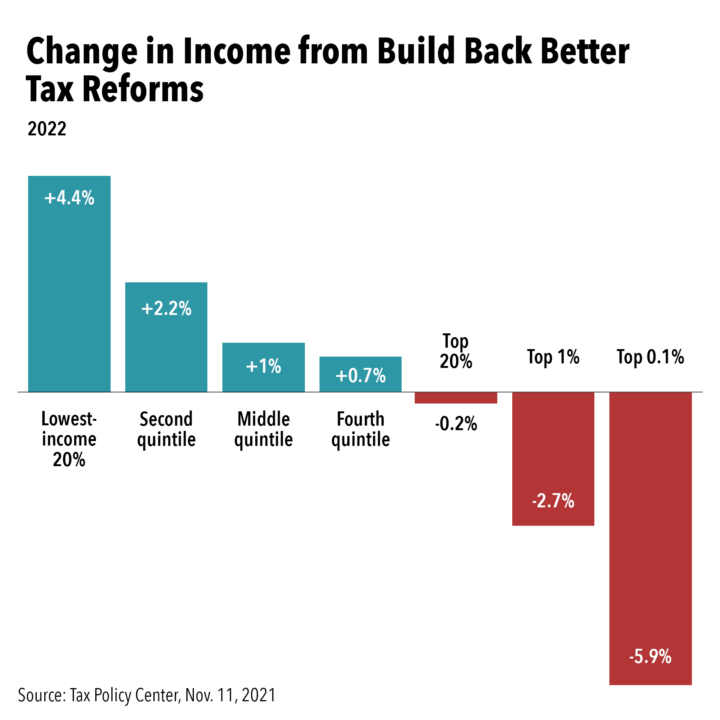

. It would reduce their 2021 taxes by an average of only 20. The Build Back Better Bill also known as the Build Back Better Act is structured to support the. Increase to individual tax rate Top individual tax rate increased back to 396 percent.

1202 There is also a provision that limits the special 75 and 100 exclusion. 18 tax rate on taxable income up to 400000. 5376 that includes more than 15 trillion in business international.

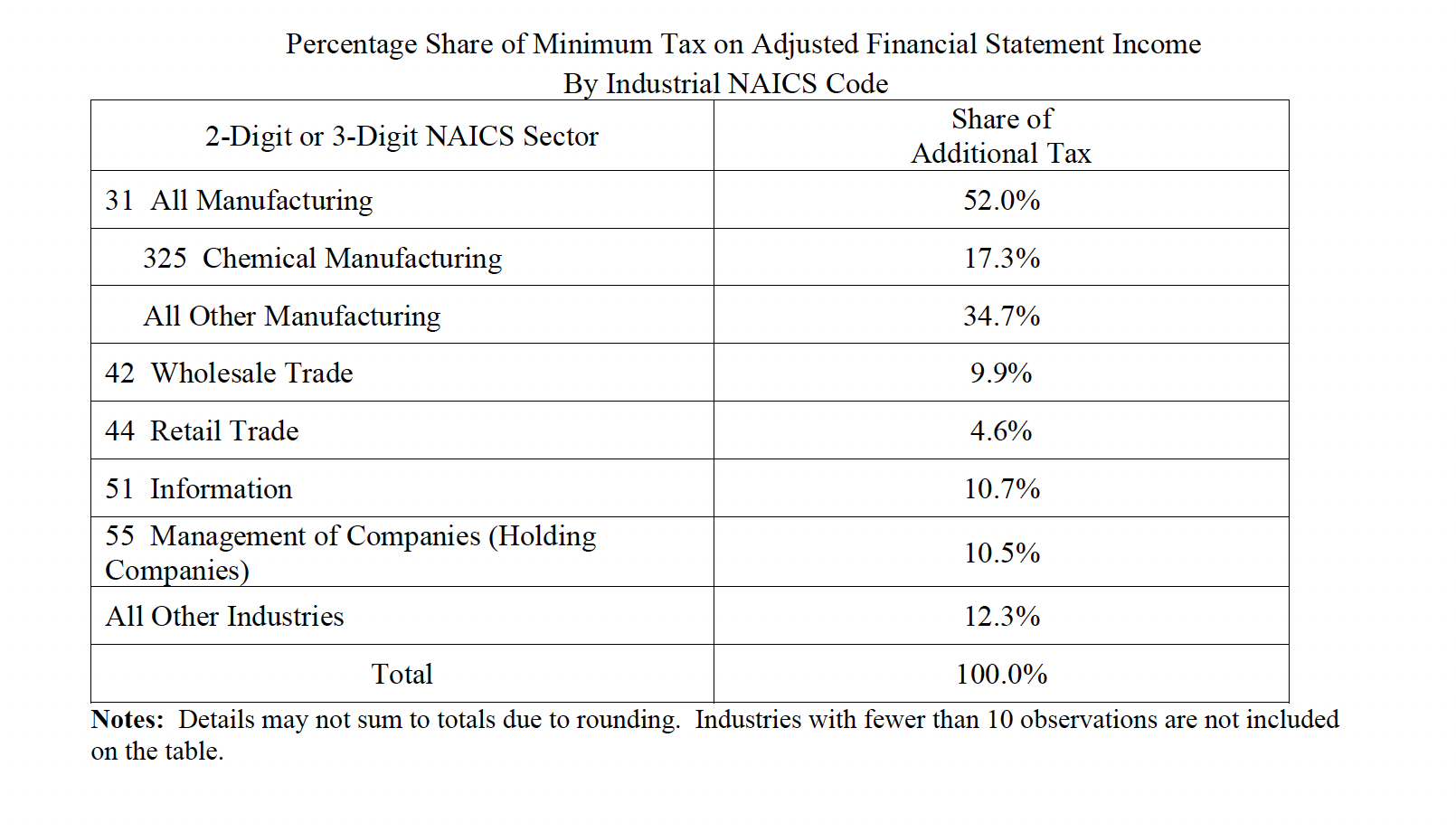

The corporate minimum tax as proposed in Build Back Better would be 15 of book income for corporations with financial statement income in excess of 1 billion. The largest pay-for in the bill is not a tax increase at all. The BBBA is often reported as a 175 trillion package but that is not the net deficit impact of the bill.

As part of the budget reconciliation negotiations United States US Senate Finance Committee Chairman Ron Wyden and Senators Elizabeth Warren and Angus King. Here is a list of the most significant tax increases in the Build Back Better Act their size and when they may become effective under the bill as currently written. Economic comeback and hurt us globally.

By collecting taxes that are already owedand disproportionately unpaid by the highest-earnersthe Build Back Better Act. It combines around 1 trillion in revenue increases roughly 15. Individual and pass-through tax.

According to a fact sheet from the White House a new Treasury Department analysis shows that the proposal wouldnt increase income tax rates on 97 of small business. Corporate Tax Rate Increase. OPINION The corporate tax increase proposal in Bidens infrastructure plan would hamstring the US.

Small Business Stock Exclusions Sec. The corporate flat tax rate of 21 would be replaced with a three-step graduated rate structure. How Build Back Better Bill will Affect Business Owners in 2022.

The House on November 19 voted 220 to 213 to pass the Build Back Better reconciliation bill HR. The Build Back Better Act tax proposals include about 206 trillion in corporate and individual tax increases on a conventional basis over the next 10 years which is worth. Key Corporate Tax Provisions Corporate Tax Increase.

Even those making between 17500 and 250000 would get a tax cut of just over 400 or about 02 percent of. Adding in 207 billion of nonscored revenue that is estimated to. The highest tax rate on job creators among our international competitors making us far less desirable as a destination for.

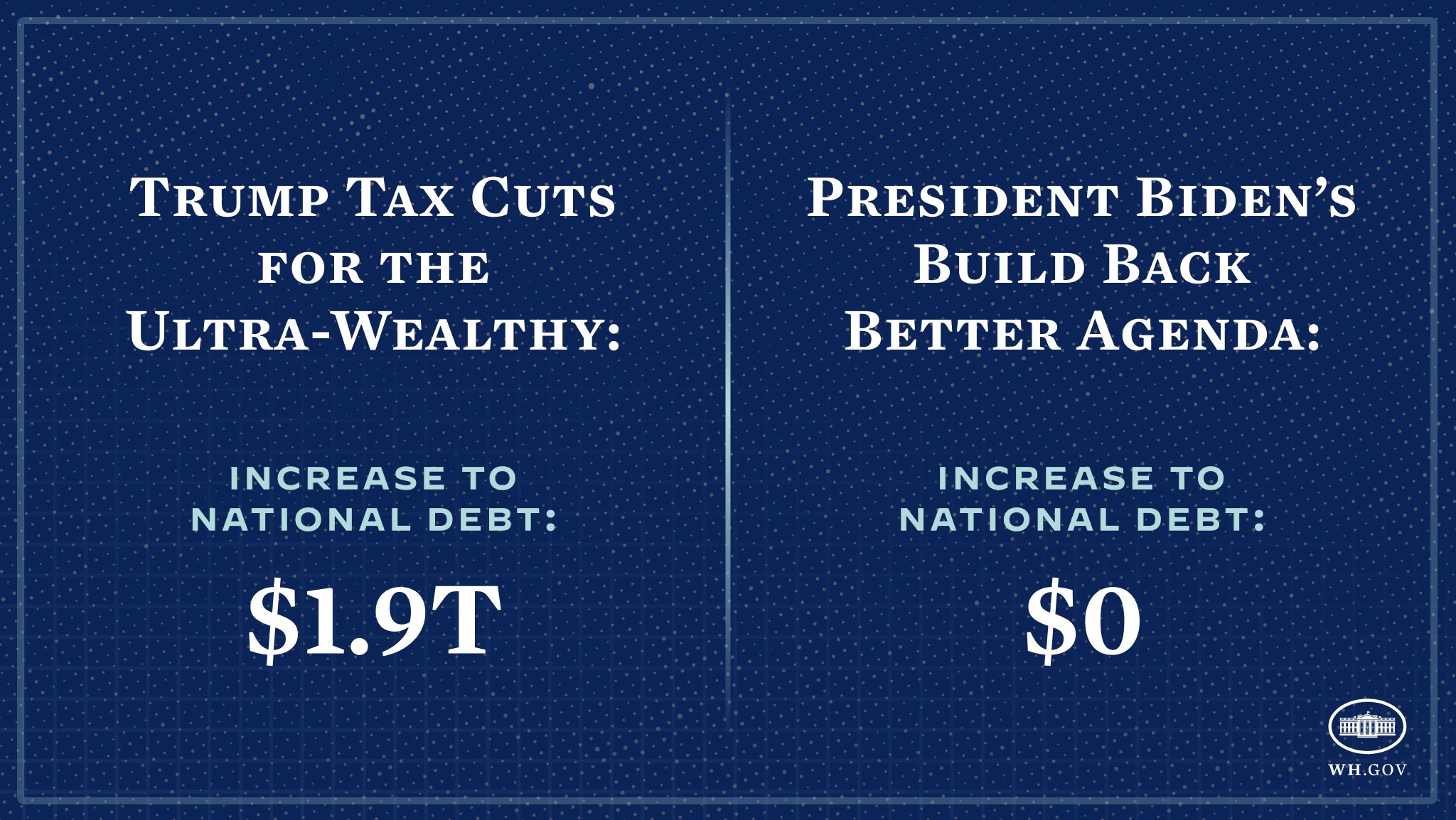

The CBO estimates the bill will cost almost 17 trillion and add 367 billion to the federal deficit over 10 years. President Joe Bidens Build Back Better agenda would raise taxes on up to 30 percent of middle-class families despite his campaign promises saying otherwise. Increase to capital gain rate Top capital gain tax rate.

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

Corporate Rates Left Alone Stock Buybacks Targeted What S In Biden S Tax Plan Marketwatch

Nonpartisan Jct Shows Made In America Manufacturers Hit Even Harder By Manchin Biden Ways And Means Republicans

45 Weekly Charts Corporate Income Tax Inflation Momentum By Alessandro Medium

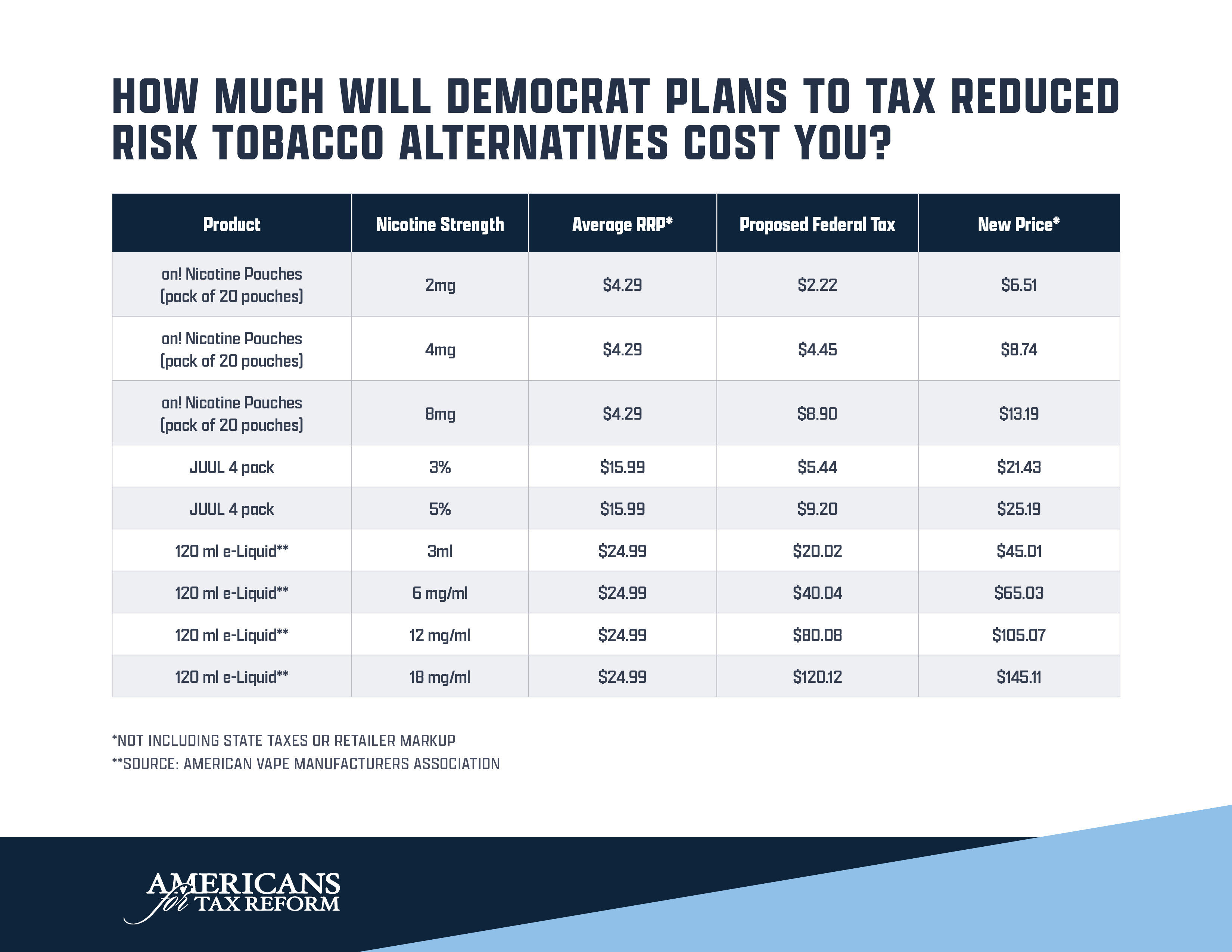

Federal Nicotine Tax Proposal Wrong Tax Base Leads To Multiple Issues

Individual Capital Gains And Dividends Taxes Tax Foundation

Build Back Better Act Will Raise Tax Rates On Millionaires Americans For Tax Fairness

No Reason To Water Down The Tax Reforms In The Build Back Better Act Itep

Inside The Democrats Battle To Build Back Better The New Yorker

Here S How Biden S Build Back Better Framework Would Tax The Rich

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

What S In The Build Back Better Bill Check This Map

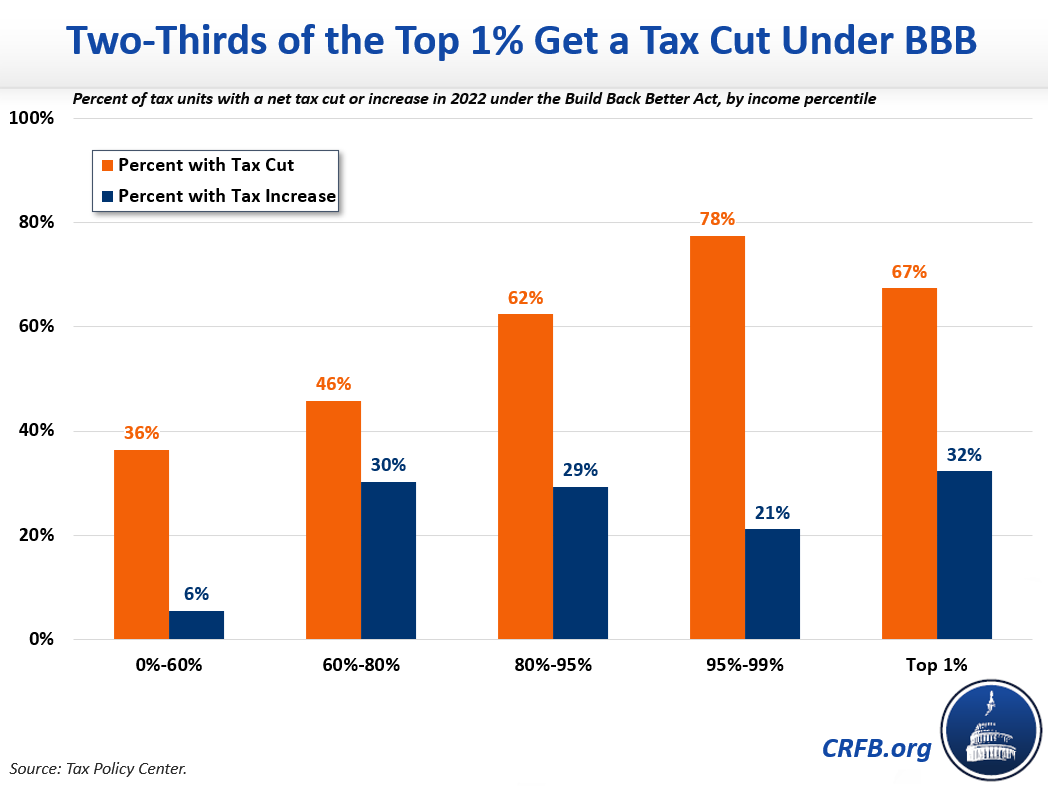

Two Thirds Of The One Percent Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Politifact Proposed Tax Increases In Build Back Better Aimed At The Wealthy Not Workers And Families

The Build Back Better Framework The White House

Salt Cap Democrats Sneaking In Tax Cut For Wealthy Into Build Back Better Plan

House Democrats Release Tax Legislative Blueprint For The Build Back Better Plan

President Biden On Twitter Here S The Deal Unlike My Predecessor S Tax Plan Every Penny Of My Build Back Better Agenda Is Paid For Https T Co T1urutbydb Twitter

What The Democrat Vape Tax Increase Will Actually Mean For Vapers Americans For Tax Reform